Ahead of the Curve – Retail sales beat forecasts in August

8 October 2018

It was pleasant news to hear last week that Australia’s retail sales rose 0.3 per cent in August, just beating market economist expectations, as consumers continued to spend despite softness in house prices and higher petrol prices.

Economists had been expecting a reading of 0.2 per cent over the month, according to Bloomberg, up from a flat reading in July.

According to data from the Australian Bureau of Statistics, cafes, restaurants and takeaway food services sales rose 0.7 per cent in August, while clothing, footwear and personal accessory retailing advanced 0.8 per cent.

Department store sales climbed 0.9 per cent but food retailing was broadly unchanged over the month. With the capacity to spend a function of wages growth and the number of people in paid employment, we should see respectable retail figures over the remainder of 2018.

As we have discussed in our previous newsletters, the small business sector is set to enjoy above-average growth in the coming years thanks to growing population and consumption.

Trade surplus up as exports jump

Trade numbers released last week showed that Australia has recorded a bumper $1.6 billion trade surplus in August, beating market expectations of a narrower surplus of $1.45 billion.

It was the eighth consecutive monthly surplus, a turnaround from Australia traditionally running trade deficits.

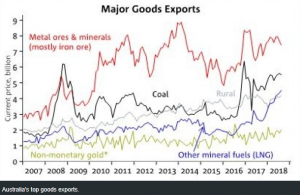

Exports edged up 0.5 per cent and imports rose 0.4 per cent. As Australia continues to run healthy trade surpluses, alongside the ongoing ramp-up in LNG and upwards trend in oil prices.

Agriculture – led by meat – also recorded a strong month, gaining 3.3 per cent. Exports of other rural goods including high-end fruits and vegetables like berries and avocados, also rose strongly.

ANZ is forecasting that tourism exports were likely to pick up in coming months as overseas visitors took advantage of the weaker Australian dollar, which fell below US71¢ last Thursday in response to a surging US bond yields pushing up the US dollar.

By Lee Xie (Senior Project Manager)

We’d love to hear your opinion and continue the discussion. Please contact lee@firstchoicebb.com.au or 0405 459 528 to discuss.

_______________________________________________________________________________________

DISCLAIMER – Any financial information within this email has been compiled by First Choice Business Brokers to provide broad general information about business opportunities and the state of the market. First Choice Business Brokers makes no representations or warranties in relation to the financial information in this email. For purchasers looking to buy, we strongly recommend that you carry out your own investigation or consult a qualified accountant before making a purchase.

__________________________________________________________________________